Finance

BREAKING: Naira Swap- CBN bows to pressure, extends deadline by 10 days

BREAKING: Naira Swap- CBN bows to pressure, extends deadline by 10 days

The Central Bank of Nigeria has extended the deadline for the swapping of old naira notes till February 10, 2023.

The CBN stated this in a release on Sunday.

Details later…

BREAKING: Naira Swap- CBN bows to pressure, extends deadline by 10 days

Finance

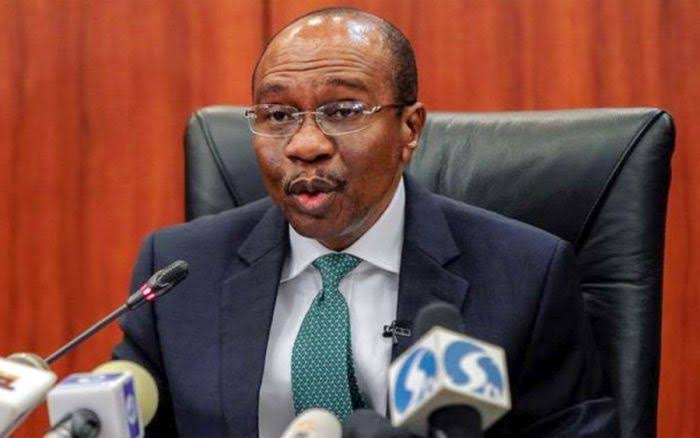

Naira Redesign: Court Summons CBN, Emefiele, AGF

Naira Redesign: Court Summons CBN, Emefiele, AGF

The Central Bank of Nigeria (CBN), its Governor, Mr. Godwin Emefiele and the Attorney General of the Federation, Abubakar Malami have been dragged to a Federal Court in Awka over the implementation of the naira redesign policy.

The redesigned currencies N1,000, N500 and N200 went into circulation on December 15, 2022, and would finally displace the old notes by the end of January 2023.

But the Incorporated Trustees of a non-governmental organisation and the African Initiative against Abuse of Public Trust had filed a suit on behalf of over 50 million Nigerians in rural areas who have to bank account, to stop the CBN from implementing the policy.

FHC/AWK/CS/195/2022 filed by Mr. N. D. Agu, on behalf of the plaintiff, the court had on November 30, 2022, delivered a ruling granting the application in part and gave an order for the defendants to be served with the motion ex parte dated November 18, 2022, but filed on November 29, 2022.

But the court presided over by Hon. Justice H. A. Nganjiwa directed the plaintiff to put the defendants on notice to compel them to appear before it and show cause why the plaintiff’s prayers should not be granted.

An Aba-based lawyer, Chief Musa Tolani, the counsel to the three defendants told journalists yesterday at the commercial city of Aba that the plaintiff’s prayers were for the court to order an interim injunction stopping the policy implementation.

According to the plaintiff, the policy on redesigned naira should not be implemented until, “a clear policy (is put in place) on how to accommodate over 50 million Nigerians without bank accounts.”

The plaintiff, therefore asked the court to issue an order restraining the defendants, particularly, the CBN and Emefiele, either by themselves or their proxies or agents, “from taking any step to enforce the implementation of the policy without protecting the interest of unbanked Nigerians.”

The reliefs sought by the plaintiff included granting accelerated hearing and determination of the substantive originating summons, granting the claimant leave to serve the defendants with the court processes by substituted means by posting or courier services.

They also prayed the court for an, “order of departure from the rules by abridging the time within which the Defendants may file their respective Counter Affidavit to substantive Originating Summons to a period of five days from the date of service of the processes.”

After the counsel informed the court that both the CBN and Emefiele had served the plaintiff with their responses to the originating process, Justice Nganjiwa granted the relief to the plaintiff to serve the third defendant, Malami with the originating summons.

However, citing, “the nature and far reaching effects,” of two of the reliefs sought, the court refused to grant an order of interim injunction restraining the defendants, especially CBN and its governor, from implementing the naira redesign policy.

It also refused to bar the CBN and Emefiele, “from taking any steps to dissipate, discountenance or in any other manner inhibit over 50 million Nigerians without bank accounts from using alternative means and or physical means to exchange old notes with the redesigned notes.”

The court said that it, “finds it very difficult to grant the said reliefs wiithout hearng from the other side” and adjourned the matter to January 19, 2023 for hearing of motion on notice for interlocutory injunction.

Naira Redesign: Court Summons CBN, Emefiele, AGF

Finance

Arewa Youths Back Emefiele, Say New Cashless Policy Timely

Arewa Youths Back Emefiele, Say New Cashless Policy Timely

The Arewa Youth Consultative Movement and the Middle Belt Youth Forum have passed a vote of confidence on the new cash withdrawal limit policy of the Central Bank of Nigeria (CBN).

This was one of the resolutions the groups read in a joint press conference by the two groups yesterday in Abuja.

The chief convener of the groups, Godwin Meliga said the policy was a lethal blow to vote buyers, money launderers, and financial criminals, saying that it is timely.

He urged all Nigerians who desire a better Nation to support the policy as it was in public interest and not designed or directed against any section of the country.

According to him, the policy is in public interest and not made to further impoverish the poor masses of Nigeria particularly in the North, while endorsing the policy.

He said the policy will hand over the control of money in circulation back to the CBN and this will enable better management and control of the economy, inflation and other factors which will enable the federal government improve the lives of citizens.

He also urged members of the National Assembly not to support any plot to use the lawmakers to oppose the cash withdrawal policy.

Meliga further claimed that the groups were in possession of information about moves by some corrupt politicians to infiltrate particularly the House of Representatives and lure the members to oppose the policy.

He further argued that this was the best time for the policy as Nigerians regularly question the timing of all policies.

The communiqué read, “We are glad to inform Nigerians and friends of the nation that Arewa and Middle Belt youths have endorsed this new well thought-out policy of the CBN.

“We have no doubt that the new policy will help the nation achieve credible election and economic growth as well as aid the fight against corruption.

“In endorsing this policy, we are mindful of the fact that politicians who specialise in vote buying are mobilising and plotting day and night to discredit President Muhammadu Buhari and the CBN Governor, Godwin Emefiele, over the policy.

“But Northern and Middle Belt Youths are hailing Buhari and Emefiele because we know and believe that the policy was formulated in public interest.

“In the long run, it is clear that this policy will fight vote buying and money laundering and expectedly, the corrupt ones among us will not like it to succeed.

“We therefore call on Nigerians to be wary of those who are bent at ensuring that they stop the policy for their selfish interest.

“As youths, we are watching. We will not hesitate to name and shame those who have resolved to stop the policy by all means.”

Meliga finally urged for support, saying with both the general election and removal of petroleum subsidy scheduled for next year, the failure of the CBN to take control of the cash in circulation leaves the country in a vulnerable position.

“And at the mercy of criminals as government cannot plan and execute plans without the correct control of the money in circulation,” he added

Arewa Youths Back Emefiele, Say New Cashless Policy Timely

Finance

CBN restricts cash withdrawals to 100,000 per week

CBN restricts cash withdrawals to 100,000 per week

The Central Bank of Nigeria (CBN) has commenced moves to limit over-the-counter cash withdrawals by individuals and corporate entities to N100,000 and N500,000 per week, respectively.

Northeast Magazine gathered that this was made known in a circular issued by the CBN on Tuesday.

According to Nigeria’s apex bank, the new policy will take effect nationwide on January 9, 2023.

The CBN stated that when the policy is implemented all cash withdrawals in excess of the above mentioned restrictions will be subject to processing costs of 5 and 10 per cent, respectively.

This online newspaper reports that this is coming after President Muhammadu Buhari unveiled the newly redesigned N200, N500, and N1000 banknotes.

Recall that the CBN governor, Godwin Emefiele, in October, revealed that the apex bank had lost track of N2.7 trillion of the country’s currency currently in circulation.

Emefiele disclosed that about 80 per cent of the country’s currency in circulation were outside the vaults of commercial banks across the country, accusing Nigerians of hoarding bank notes and refusing to take them to financial institutions.

CBN restricts cash withdrawals to 100,000 per week

-

News2 years ago

News2 years agoRoger Federer’s Shock as DNA Results Reveal Myla and Charlene Are Not His Biological Children

-

Opinions4 years ago

Opinions4 years agoTHE PLIGHT OF FARIDA

-

News11 months ago

News11 months agoFAILED COUP IN BURKINA FASO: HOW TRAORÉ NARROWLY ESCAPED ASSASSINATION PLOT AMID FOREIGN INTERFERENCE CLAIMS

-

News2 years ago

News2 years agoEYN: Rev. Billi, Distortion of History, and The Living Tamarind Tree

-

Opinions4 years ago

Opinions4 years agoPOLICE CHARGE ROOMS, A MINTING PRESS

-

ACADEMICS2 years ago

ACADEMICS2 years agoA History of Biu” (2015) and The Lingering Bura-Pabir Question (1)

-

Columns2 years ago

Columns2 years agoArmy University Biu: There is certain interest, but certainly not from Borno.

-

Opinions2 years ago

Opinions2 years agoTinubu,Shettima: The epidemic of economic, insecurity in Nigeria