National News

Concerned ECOWAS Parliamentarians Call for Lifting of Sanctions on Niger

Concerned ECOWAS Parliamentarians Call for Lifting of Sanctions on Niger

By: Michael Mike

A call has been made for the lifting of the sanctions imposed by the Economic Community of West African States (ECOWAS) on Niger following the coup d’etat that ousted President Mohamed Bazoum.

The Head of State in ECOWAS had last July imposed sanctions on Niger Republic over the Bazoum ouster by some military officers led by erstwhile Presidential Guard Commander, General Abdourahamane Tchiani. This decision seems to be supported by many Western governments.

But on Wednesday at the opening of the 2nd Ordinary Session of ECOWAS Parliament for 2023 in Abuja, a group of parliamentarians of the Economic Community of West African States (ECOWAS) Parliament concerned with the turn of affairs in the troubled country, appealed to the Heads of State and Government in the region to lift the sanctions imposed on the Niger Republic.

The Chief Whip of the Nigerian Senate, who is also a member of the ECOWAS Parliament, Senator Ali Ndume, while addressing journalists after the opening session of the parliament, said the sanctions were biting hard on the masses including Nigerians in the border states.

Ndume said: “Niger is bordering about eight states in Nigeria, namely Borno, Yobe, Kano, Katsina, Sokoto, Zamfara, and Kebbi. Since the closure of the border and the imposition of sanctions, poor people especially children and women have been exposed to untold hardship and no meaningful progress have been made in term of resolving this issue.

“We are, therefore, using this opportunity of the 2nd extraordinary session of the ECOWAS Parliament to appeal to the ECOWAS Head of State to intensify the resolution of the political impasse in Niger by first lifting the sanctions and opening the closed border of Niger and Nigeria.

“Let me add by saying that this is a collective decision by some of us who are concerned about what is going on and the suffering our people are going through.”

He added that: “This also affects other non-border countries because Niger is a lead way for goods moving from Sokoto to Ghana, goods moving from Togo to Nigeria, and goods moving from several parts of the ECOWAS countries from the West down to the North.”

The lawmaker said they thought the sanctions were temporary and the issues would have been resolved, “but it’s getting to four or five months into the political impasse, the only thing we know that is happening is the increased suffering of the poor people of Niger and to some extent, Nigeria.”

The Senator representing Borno South in the upper chamber of Nigeria’s National Assembly argued that the group was reechoing the position of the parliament, adding that the parliament had set up an ad-hoc committee, which he is a member of, to proffer solutions to the impasse in Niger.

He said the committee had submitted an interim report, noting that: “One of the resolutions which were endorsed by all the parliamentarians is the lifting of sanctions and the continuation of discussion on how to resolve the impasse. We are only reechoing the position of the ECOWAS parliament.”

Also speaking, Hon Abdullahi Balarabe Salame, from Sokoto, said his people were suffering from the sanctions on Republic of Niger.

He lamented that thousands of trailers loaded with food items to be transported to Niger were stranded at the order, lamenting that the food items were already decaying.

He said the border closure is also increasing insecurity in the region.

Meanwhile, the President of the ECOWAS Commission, Omar Alieu Touray, has called for concrete actions to safeguard democracy and to restore the region as the bastion of democracy in Africa.

Touray made the call in his address at the opening of the fifth Parliament’s second ordinary session of the ECOWAS Parliament of the year 2023.

Said the Republic of Niger, Burkina Faso, Mali, and Guinea have all experienced coups recently, creating fears that democracy could be in danger in the region.

He said: “The resurgence of coup d’états has challenged us all in more ways than one and led us to reflect on what is not working in our process of consolidating democracy.

“As politicians, you are best suited to guide us on what we must do to tackle the root causes of all these unconstitutional changes of government.

“We count on your wisdom to help in safeguarding the rights of our people and for the preservation of peace, security, and stability, which are necessary for our socio-economic development and regional integration process,” he said while addressing the parliament.

The ECOWAS Commission president said, at the political level, ECOWAS was engaging in dialogue with the Member States in transition, namely Burkina Faso, Mali, and Guinea, in order to support them to return to normal constitutional order through the organization of free, transparent and inclusive elections.

“As far as the Republic of Niger is concerned, we adhere to the guidance of the current Chairman of ECOWAS to resolve this crisis through dialogue and negotiation.

“On the security front, the region continues to suffer from attacks by armed groups and terrorists who seriously threaten the territorial integrity of Mali and Burkina Faso, resulting in loss of life, material damage and millions of displaced persons and refugees.

“In this regard, we continue to provide multifaceted support to help these countries face these challenges, despite the sanctions,” he said.

Speaking earlier, the Speaker of the ECOWAS Parliament, Dr Sidie Mohammed Tunis, noted that the region’s prosperity and security are inextricably linked to its members shared responsibility to look out for one another.

He said: “Only a foolish neighbour goes to bed when his neighbour’s roof is on fire,” Tunis said. “In a region of interconnected threats and challenges, we can only address our issues effectively through broad, deep, and sustained cooperation among states.”

Tunis also called for greater self-reliance from ECOWAS member states. He said that the region cannot rely on outside help to solve its problems.

“We need to be more self-reliant,” Tunis said. “Each Member State must take on more responsibility for the development and advancement of the ECOWAS region.”

He noted that despite its numerous challenges, the ECOWAS region is on the right track, pointing to the recent successful presidential and legislative elections in the Republic of Liberia as a sign of progress.

He said: “The people of Liberia have shown us that democracy is possible in our region,” insisting that: “We can all learn from their example.”

Tunis also praised the ECOWAS Authority of Heads of State and Government for its leadership in sustaining peace and security in the West African region.

Concerned ECOWAS Parliamentarians Call for Lifting of Sanctions on Niger

National News

Reps Hearing: Ojukwu, Stakeholders Push for Stronger NHRC, Legal Shield for Human Rights Defenders

Reps Hearing: Ojukwu, Stakeholders Push for Stronger NHRC, Legal Shield for Human Rights Defenders

By: Michael Mike

A coalition of government officials, lawmakers and civil society leaders have rallied behind sweeping reforms to strengthen Nigeria’s human rights architecture, as the House of Representatives held a public hearing on two key bills aimed at reinforcing the mandate and independence of the National Human Rights Commission (NHRC).

At the centre of deliberations were the National Human Rights Commission Act (Repeal and Re-Enactment) Bill, 2025 and the Human Rights Defenders Protection Bill, 2024 — proposals advocates say could redefine institutional safeguards for rights protection in the country.

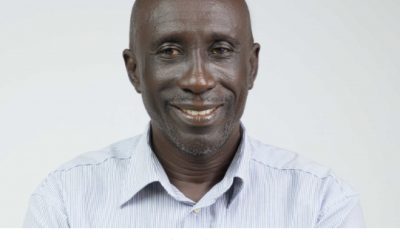

Leading the charge was the Executive Secretary of the NHRC, Tony Ojukwu, who argued that the existing legal framework no longer sufficiently addresses emerging human rights realities.

He maintained that the repeal and re-enactment of the Commission’s Act would entrench greater operational independence, improve oversight functions and guarantee sustainable funding.

According to Ojukwu, the proposed legislation clearly identifies funding streams for a National Human Rights Fund, designed to ensure financial autonomy and enable rapid response in emergencies. He noted that the bill would formally incorporate the National Preventive Mechanism within the Commission, strengthening independent monitoring of detention facilities and reinforcing safeguards against torture and inhumane treatment.

He also said the bill would provide statutory backing for the National Action Plan on Business and Human Rights, a move aimed at holding corporate actors accountable for rights violations and promoting responsible business conduct.

In a significant institutional reform, the bill proposes that the Executive Secretary of the Commission must emerge from within its directorate cadre, rather than being appointed externally. Ojukwu said the measure would preserve professionalism and continuity in the Commission’s leadership.

On the Human Rights Defenders Protection Bill, he stressed that individuals and groups advocating for justice often operate under threats, harassment and intimidation. The proposed law, he explained, would create legal protections and response mechanisms to shield them from reprisals.

Speaker of the House, Tajudeen Abbas, represented by Hon. Useni Jalo, reaffirmed the legislature’s commitment to strengthening democratic institutions through progressive lawmaking. He described the hearing as part of broader efforts to consolidate citizens’ trust in governance.

International partners also signalled support. The United Nations Resident and Humanitarian Coordinator in Nigeria, Mohammed Fall, represented by Ms. Ajuwa Kufour, said passage of the bills would further align Nigeria’s human rights institution with the Paris Principles, the global benchmark for national human rights bodies.

Chairman of the House Committee on Human Rights, Hon. Abiola Makinde, assured stakeholders that the legislative process would remain transparent and inclusive, pledging sustained engagement with civil society and government agencies.

However, dissenting views emerged from the Federal Ministry of Justice. Imarha Reuben, representing the Attorney General of the Federation and Minister of Justice, Lateef Fagbemi, cautioned against what he described as legislative proliferation. He argued that Nigeria already possesses adequate legal frameworks and urged lawmakers to focus on harmonising and effectively implementing existing laws rather than enacting new ones.

Despite the differing perspectives, stakeholders broadly agreed that strengthening the NHRC’s legal and institutional framework remains critical to advancing accountability, safeguarding dignity and deepening Nigeria’s democratic culture.

The hearing closed with renewed calls for collaboration between the legislature, executive and civil society to ensure that reforms translate into meaningful protection for ordinary Nigerians.

Reps Hearing: Ojukwu, Stakeholders Push for Stronger NHRC, Legal Shield for Human Rights Defenders

National News

Shehu Dikko Endorses President Tinubu for Second Term

Shehu Dikko Endorses President Tinubu for Second Term

By Comrade Philip Ikodor

Abuja, Nigeria – The Chairman of the National Sports Commission (NSC), Shehu Dikko, has called on Nigerians to support President Bola Ahmed Tinubu’s bid for a second term in office come 2027. Dikko made this assertion at the Grand Endorsement event of President Tinubu’s re-election, organized by the National Progressive Hub (NPH), a prominent support group of the All Progressives Congress (APC), held at the Shehu Yaradua Center in Abuja.

Dikko, who hosted the event, highlighted the achievements of the Tinubu administration, including the establishment of the National Sports Commission, which has driven reforms and innovations in sports administration in Nigeria. He also commended the President’s industrial revolution drive, which has led to economic stability and development.

“President Bola Ahmed Tinubu is a great leader committed to positioning Nigeria as a leading nation. His bold economic policies and interventions have yielded positive results,” Dikko said. He also praised the President’s recent executive bill, which mandates key institutions to remit generated revenue directly to government coffers, calling it a significant step towards economic development.

The event also featured the formal inauguration of the 36 state coordinators and the FCT of the National Progressive Hub (NPH) and the unveiling of the Roadmap Framework for strategic grassroots engagement towards the APC’s victory in 2027.

The NPH, a leading APC support group, has thrown its weight behind President Tinubu’s re-election bid, citing his remarkable achievements and commitment to Nigeria’s development. The group is set to mobilize support for the President across the country, leveraging its extensive network and grassroots presence to ensure a landslide victory for the APC in 2027.

The NPH’s endorsement is seen as a significant boost to the President’s re-election campaign, and a testament to his growing popularity and influence among Nigerians.

Shehu Dikko Endorses President Tinubu for Second Term

National News

FG Moves To Democratise Credit Access, Inaugurates CREDICORP Board

FG Moves To Democratise Credit Access, Inaugurates CREDICORP Board

We’re targeting 50% of working population by 2030, says VP Shettima

By: Our Reporter

The Vice President, Senator Kashim Shettima, has inaugurated the Board of the Nigerian Consumer Credit Corporation (CREDICORP), saying access to consumer credit is critical to Nigeria’s ambition of becoming a one-trillion-dollar economy.

According to him, President Bola Ahmed Tinubu established the CREDICORP to build a trusted credit infrastructure, provide catalytic capital to lower borrowing costs, and help Nigerians overcome long-standing cultural resistance to credit.

Speaking on Thursday in Abuja when he inaugurated the Board on behalf of the President, the Vice President said that the quality of life of Nigerians cannot improve without closing the gap between access to capital and human dignity.

“A civil servant who earns honestly does not have to chase sudden wealth just to buy a vehicle, or save for ten years to buy one. A young professional should not remain in darkness simply because solar power must be paid for all at once,” the Vice President said.

VP Shettima disclosed that in just one year of operations, CREDICORP has disbursed over ₦37 billion in consumer credit to more than 200,000 Nigerians, with over half of them accessing formal credit for the first time.

The Vice President said the organisation is specifically tasked with building credit infrastructure to bridge the trust gap between lenders and borrowers, providing wholesale capital and credit guarantees through its portfolio company.

“Ultimately, these critical jobs of CREDICORP will enable access to consumer credit to at least 50 per cent of working Nigerians by 2030,” he said.

The Vice President explained that the new board’s role is not ceremonial as they are custodians of the organisation’s mission, adding that the long-term strength of the institution would depend on their “vigilance, integrity, sacrifice, and commitment.”

He directed Board members to uphold Public Service Rules, the Board Charter, and all applicable governance frameworks, warning that accountability and stewardship of public resources were non-negotiable.

Earlier, Chairman of CREDICORP, Otunba Aderemi Abdul, expressed appreciation to President Tinubu for his vision behind the formation of CREDICORP and for the confidence reposed in them, noting that the establishment of Corporation marked an important step towards strengthening the nation’s financial architecture.

He assured President Tinubu that the board understands its responsibility and will guide the institution to deliver meaningful benefits to Nigerians.

For his part, Engr. Uzoma Nwagba, Managing Director/CEO of CREDICORP, recalled watching President Tinubu saying 20 years ago that consumer credit is one of the major tools that will improve the lives of Nigerians.

He noted that over the past 18 months, the institution has benefited more than 200,000 Nigerians, including students.

He assured that the presidential vision behind CREDICORP would not be taken lightly, as the team considers their appointments a unique, once-in-a-lifetime opportunity.

Other members of the board inaugurated include Olanike Kolawole, Executive Director, Operations; Aisha Abdullahi, Executive Director, Credit and Portfolio Management; Dr. Armstrong Ume-Takang (MD, MoFI), Representative of MoFI; Engr. Bisoye Coke-Odusote (DG, NIMC), Representative of NIMC; and Mohammed Naziru Abbas, Representative of FMITI.

Others are Marvin Nadah, Representative of FCCPC; Chinonyelum Ndidi, Representative of the Federal Ministry of Finance; Mohammed Abbas Jega, Independent Director; and Toyin Adeniji, Independent Director.

FG Moves To Democratise Credit Access, Inaugurates CREDICORP Board

-

News2 years ago

News2 years agoRoger Federer’s Shock as DNA Results Reveal Myla and Charlene Are Not His Biological Children

-

Opinions4 years ago

Opinions4 years agoTHE PLIGHT OF FARIDA

-

News11 months ago

News11 months agoFAILED COUP IN BURKINA FASO: HOW TRAORÉ NARROWLY ESCAPED ASSASSINATION PLOT AMID FOREIGN INTERFERENCE CLAIMS

-

News2 years ago

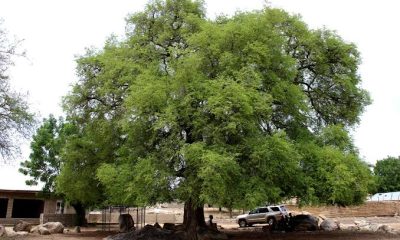

News2 years agoEYN: Rev. Billi, Distortion of History, and The Living Tamarind Tree

-

Opinions4 years ago

Opinions4 years agoPOLICE CHARGE ROOMS, A MINTING PRESS

-

ACADEMICS2 years ago

ACADEMICS2 years agoA History of Biu” (2015) and The Lingering Bura-Pabir Question (1)

-

Columns2 years ago

Columns2 years agoArmy University Biu: There is certain interest, but certainly not from Borno.

-

Opinions2 years ago

Opinions2 years agoTinubu,Shettima: The epidemic of economic, insecurity in Nigeria